Presentation Budget Materials

Municipal Budget for FY’10

TOWN OF KITTERY DRAFT MUNICIPAL AND EDUCATION BUDGET FOR FY'10

SUBMITTED TO THE TOWN COUNCIL MARCH 16, 2009

BUDGET CALENDAR SUBJECT TO CHANGE

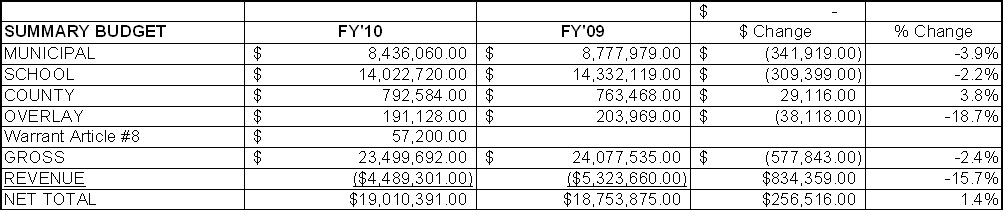

The Kittery Town Council held a budget hearing on June 22, 2009 on the Municipal and Adult Education Budgets. This followed the June 9h voter approved School Budget. The below chart is the entire Municipal and Educational budget as approved. The Tax Rate will be set in October and tax bill sent in November with ½ due in December 2009.

The Memorandum that follows is the revised Municipal budget message from the Town Manager to the Council.

Memorandum

To: Town Council

From: Jonathan Carter, Town Manager

Re: FY’10 Budget-Revised

Date: June 18, 2009

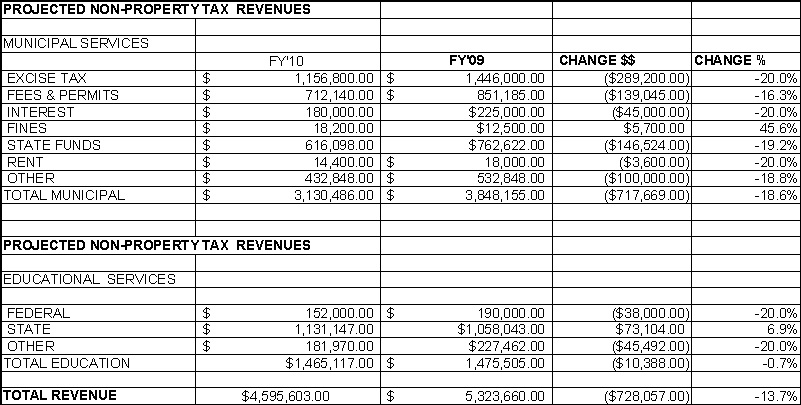

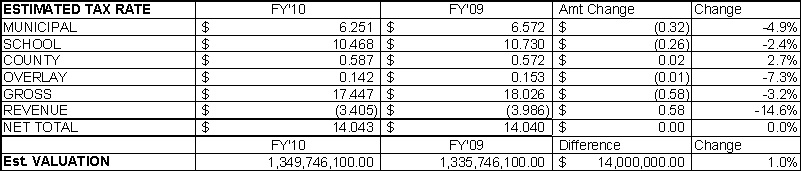

This memo revises the earlier spring Manager FY’10 Budget Transmittal Message to the Kittery Town Council per Article VI, Sections 6.02 and 6.03 of the Town Charter. The Municipal Operating Budget for Council Approval on June 22nd includes the Municipal Operating Budget and the Adult Education Budget which is enclosed in summary. The gross municipal budget reflects a 3.89 % decrease while overall non-property tax revenue is forecast to be 15.7% lower than in the present budget resulting in a 1.4% projected increase. As now proposed, the budget attempts to come in with a flat tax rate with the exception of the voted warrant article on June 9, 2009 for Mosquito and Tick control for an additional 57,200 from property taxes. Please note the school validation vote on June 9th approved the Council school budget passed on June 1st, 2009. The actual tax rate will not be set until the fall of this year and the town has many challenges between now and then to maintain the integrity of the proposed budget from recessionary and possible voted revenue reductions and achieving the projected new property valuation goals.

The entire budget for FY’10 in greater summary detail can be seen on the Town Website www.kitteryme.gov under Town Documents..

Memorandum

To: Town Council

From: Jonathan Carter, Town Manager

Re: FY’10 Budget-Revised

Date: June 18, 2009

This memo revises the earlier spring Manager FY’10 Budget Transmittal Message to the Kittery Town Council per Article VI, Sections 6.02 and 6.03 of the Town Charter. The Municipal Operating Budget for Council Approval on June 22nd includes the Municipal Operating Budget and the Adult Education Budget which is enclosed in summary. The gross municipal budget reflects a 3.89 % decrease while overall non-property tax revenue is forecast to be 15.7% lower than in the present budget resulting in a 1.4% projected increase. As now proposed, the budget attempts to come in with a flat tax rate with the exception of the voted warrant article on June 9, 2009 for Mosquito and Tick control for an additional 57,200 from property taxes. Please note the school validation vote on June 9th approved the Council school budget passed on June 1st, 2009. The actual tax rate will not be set until the fall of this year and the town has many challenges between now and then to maintain the integrity of the proposed budget from recessionary and possible voted revenue reductions and achieving the projected new property valuation goals.

Memorandum

To: Town Council

From: Jon Carter, Town Manager

Re: FY’10 Budget Transmittal

Cc: Department Heads

Date: 3/16/09

______________________________________________________________

The enclosed budget is transmitted to Council as required under the Charter Sections 6.02 and 6.03. The enclosed budget binders are set up with index and separated by budget categories with corresponding information. The Town Council and School Committee have had early fall meetings discussing the FY’10 Budget. The Council has set the guidelines of attempting to maintain a “no tax increase” within the budget. The FY’10 Budget development process has been undertaken internally for the last 90 days and by the school department for a longer period. With the development of this year’s budget, two, half day leadership team meetings took place between the department heads school administrators and the School Superintendent and Town Manager. The first meeting was facilitated and the second was a continuation of a discussion of efficiency and collaborative ideas from the first meeting. Although no new initiatives were ultimately developed from those meetings, it was found to be useful and beneficial and will continue.

The process of developing the FY’10 Budget was assisted by our new School Business Manager / Town Fiscal Agent, Sheri Rockburn. Future budgets will have a different look as the town and school combine financial offices and move onto the same chart of accounts.

During the 90 days of budget preparation, the new Capital Improvement Committee met and undertook the development of its first multi- year CIP Plan that has been submitted to Council for its review and recommendations which can be found with the draft Warrant Articles under Tab 7.

The spirit in which the FY’10 Budget was developed was one with a clear understanding of the economic environment that we operate in today. The downturn economy and suffering that is taking place was and is in the forefront of our thinking by our employees and those involve in the development of this budget. Our collective efforts was to avoid reductions in services and our overall government effectiveness while achieving the objective of not raising the tax rate. The budget submitted maintains the tax rate if projections of valuation growth and revenue forecasts our met.

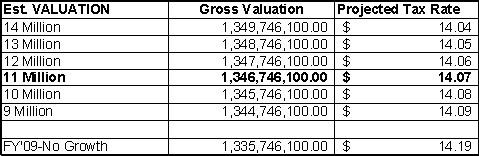

The budget submitted does not provide for growth in services and does in fact reduce the amount of infrastructure maintenance and services that will take place such as road repair; does not fill a patrolman’s position, no raises for fire stipend employees; closure of the recreation pool; decreased depreciation reserve funding; purchases of equipment is put off; decreased overtime budgeted and the list of reductions could fill several pages. However, on the municipal side we have accomplished the budget objective without layoffs of municipal employees and meeting the town’s employment contract obligations. The resulting budget is one that is held together with rubber bands and in this economic environment may be stretched and broken and need repair on a regular basis by everyone working together. This is the second year of decreasing budgets. All said, the expected FY’10 Budget does maintain the present Kittery Tax Rate of $14.04 if revenue and valuation projections are met.

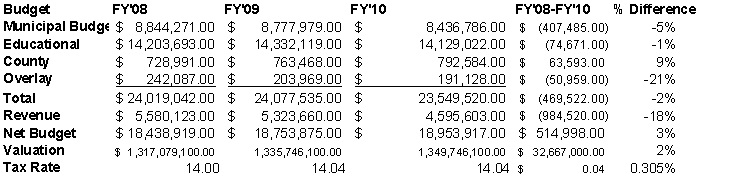

Comparison Table: FY’08 –FY’10

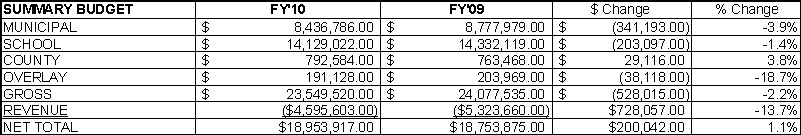

Comparison Table: FY’10 vs FY’09

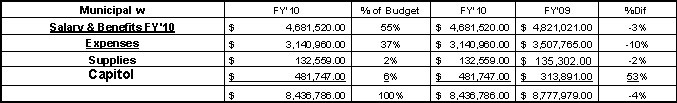

Budget Components:

· Municipal Operations –

§ All but two budget accounts have decreased in order to achieve the no tax increase goal FY’10:

· Those that reflect increases are ones out of our control such as the County Tax and Insurances.

· The Municipal Budget has decreased by 4% excluding the County Tax from the FY’09 Budget

· The breakdown of the Municipal Budget is a follows:

Other aspects of the FY’10 Budget

§ LD 1 –Tax Cap- Projected to be under the cap

§ The Undesignated surplus as of June 30, 2008 was $5.6 Million. The projected balance currently is around $4.8 million with voted warrant articles for FY’09 undertaken.

§ Warrant Articles for FY’10 (Tab 7) are decreased with several projected to be funded by Taxation which are not factored into the projected tax rate of $14.04.

§ The CIP Plan (Tab 7) has re-allocated several of the Department’s Capital Depreciation Accounts into the CIP Plan from those department’s operational budgets. When reviewing budgets, this can be missed.

§ The Debt Payment on the Municipal side has decreased by $101,710 in FY’10. Overall long-term debt by the Town is approximately 15,899,147 as of June 30, 2008.

§ Community Agencies request are listed with submitted materials not copied but available from the Town Manger. They were recommended for funding at 3.55% less then last years approved levels.

§ The memberships to Maine Service Center Coalition and Eastern Trails Management District were not funded for FY’10.

Included in this years transmission materials are slides from a Power Point Budget presentation assembled by Sheri Rockburn our new Business Manager / Town Fiscal Agent. I want to thank her for her assistance with the budget. I also want to recognize the hard work that all the Department Heads have put into this year’s budget development and to Maryann Place for her assistance with the Budget development and keeping the budget book and contents to $7 each with their production and purchase.

Lastly the Budget Calendar has the following dates scheduled for Budget / CIP /Warrant Article reviews.